Today Shopline announced closing it’s seed round of US$1.2 million! Congrats Team Shopline – Raymond, Tony and Fiona! Some more details include:

- Completed the 500 Startups Accelerator program in San Franciscoseveral months ago (Batch 10).

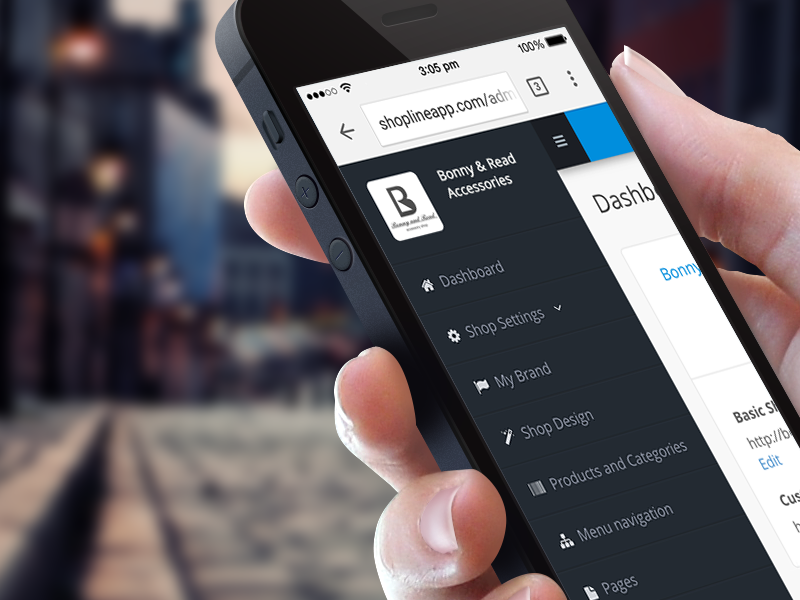

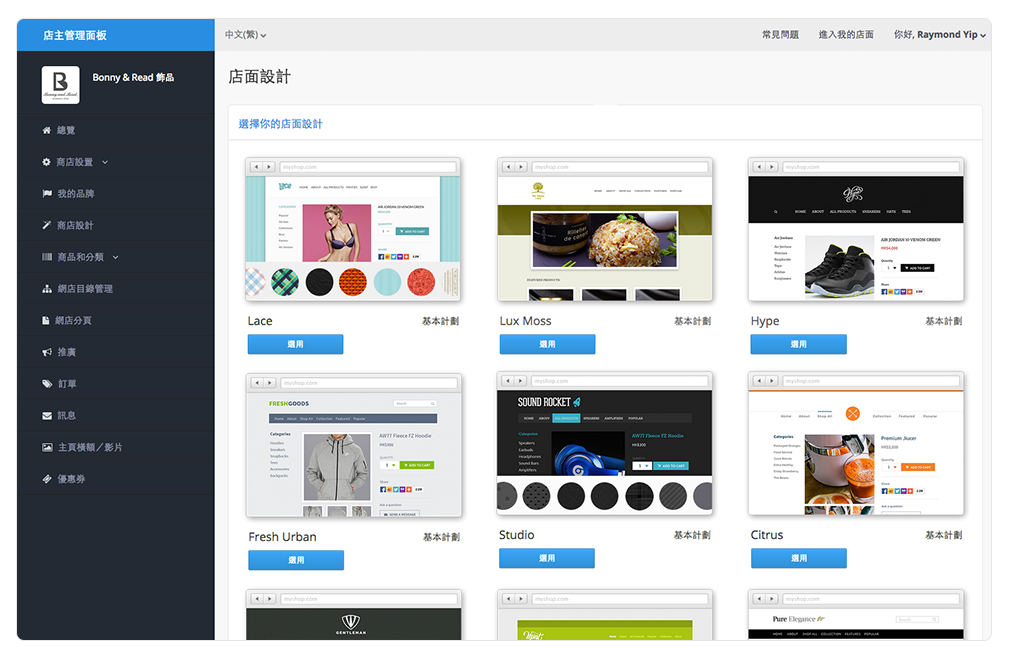

- funding will allow Shopline to positionitself as the go-to online shop builder in Asia, beginning with Hong Kong and Taiwan.

- looking to expandinto select markets in SEA later this year.

- Investors include 500 Startups, Ardent Capital – founding investor of aCommerce, SXE Ventures –an early stage fund by Danny Yeung, co-founder of Groupon HK, East Ventures and COENT Venture Partners.

We asked Raymond Yip, co-founder and CEO to expand on what he learned raising this money to share with Hong Kong startups.

Fundraising can seem like a daunting task to first time entrepreneurs, especially those who have never fundraised before in any capacity. While you can listen to endless talks about startup fundraising, you really will not know until you get out there and start. One thing I would recommend is that entrepreneurs should seek out suggestions from other startup founders who have successfully raised funds before. These are the people that have seen the good, bad and the ugly sides of fundraising and you can learn a lot from their mistakes.

One thing I learned along the way is that fundraising should always be a two way street. It is still a business transaction at the end of the day and you really need to make sure the deal is never heavily skewed toward either side. While startup valuations are certainly toward the high end as of late, and investors will remind founders to be realistic in their expectations, entrepreneurs should be aware of, and believe in, the true potential of the product they are building. I am being very general here but If you find yourself continuously negotiating on valuation with an investor (at least at the seed stage), perhaps that investor isn’t a good match.

One other thing is that you should be constantly practising your pitch. Your two-sentence pitch, your 30-second elevator pitch, your 3-minute on-stage pitch, etc. Practice makes perfect and you are always ready to get in front of an audience and confidently pitch your startup. This is not to say you will always be pitching on a stage, but having these down pat makes your coffee meetings that much easier. When we did pitch-prep at 500 Startups, I literally did the the Shopline pitch in front of others and by myself hundreds of times, during a 6 week period leading up to Demo Day. After that, I can basically pitch in my sleep. You get the jitters out of the way and your message and delivery will improve over time. The confidence you gain from that is immeasurable, and it will show during your private meetings with investors.

Shopline received funding from different places, such as the Valley, Hong Kong, Southeast Asia and New York. There are some early stage funds and a few angels as well. In the beginning, we were talking to investors from all over the world, but our fundraising didn’t really begin until we were accepted to the 500 Startups accelerator. From there, we had garnered much more interest and we started to close our first investments. A majority of our funding came from investors that have either run successful e-commerce businesses before or are heavily invested in other ecommerce related startups.

I have been asked this many times before and I really want to stress the importance of finding investors that either A) have operational experience in the past, or B) are well connected or have stake in the businesses in your particular niche or market. There is nothing wrong with pure money and for startups, some times having pure money is better than having no money at all. However, founders should always look for investors that can really help them in the long run, whether it be guidance, real business advice or just connections with the right people.

From my experience, investors always look for a few key things, everything else are just good to have. At least at the seed stage. First and foremost, and you probably heard this before, is the team. This is a peoples’ game. Most investors understand that the risk for startup investing is extremely high, and there are absolutely zero guarantee of any return. However, if you can demonstrate that you have the right team, you can make a much more convincing case. A proven track record for execution, previous startup experience or exits, experience in the particular niche – these can all set you apart. Having more than one founder, each with complimentary expertise can also help. The other side of that is really a sales job on your part. No matter how much you believe that you have the right team to succeed, if you can not convey that confidently to investors then it makes it that much harder for them to buy in.

Secondly, investors generally look for things they understand, and that they understand the problem your product or service is solving. You’ll need to communicate effectively why your product should exist and that the problem is big enough to warrant an actual company dedicated to solving it. Again, it’s all in your pitch and how you can convey that message.

Finally, market size. Once you have demonstrated that you have a problem worth solving and your have the team to do it, you need to convince them that there is a bigger ambition to your startup. Most investors are looking for that one big win, and they’re looking for something that can potentially go global, or at least regional. Solving a problem for one small city is usually not enough to warrant immediate interest. The question will inevitably be “So you can win this market, great. Then what?” If you have a big dream, and you truly believe your product has that potential, then go ahead and paint that picture and sell it like a Picasso.

Raymond Yip

Co-Founder, CEO, Shopline

StartBaseHK

LinkedIn

AngelList

Twitter

Shopline

StartBaseHK

AngelList