The Financial Technology or FinTech scene keeps getting hotter and hotter in the city that was built for it in Asia. So its no surprise that more events revolving around this industry are happening in Hong Kong.

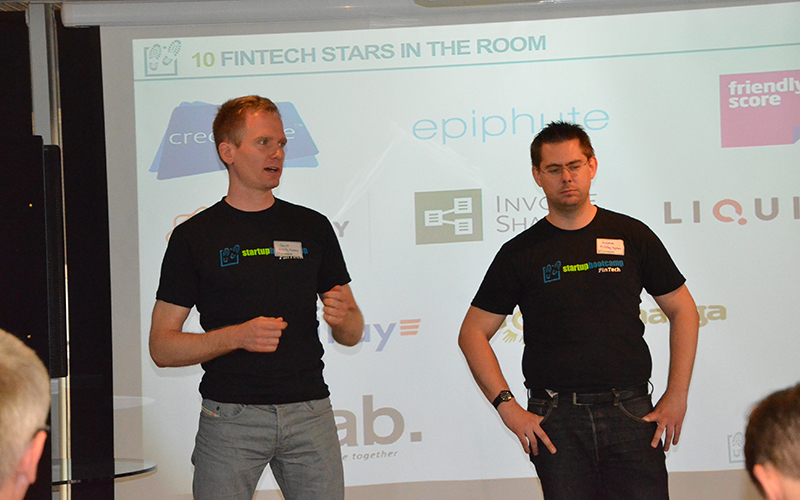

We sat down with Markus Gnirck the co-founder and COO of StartupBootCamp to throw some light on the upcoming pitch day on 27 January 2015 at PaperclipHK.

Who are you and What is StartupBootCamp FinTech?

I am Markus, co-founder & COO of Startupbootcamp FinTech. Startupbootcamp FinTech is the leading accelerator for FinTech startups with two programs across the globe, one in London and one in Singapore. In each location we partner with leading financial institutions and funds (MasterCard, DBS, Lloyds, SBT Venture Capital and more) to support 10 startups in a 13 weeks acceleration program.

Startups benefit from direct access to our partnering organisations, a worldwide network of over 300 mentors, angels and investors in the FinTech space. Being one of the selected Startupbootcamp FinTech startups gives directly a great amount of exposure and credibility.

Why are you bringing this to Hong Kong?

After our first Pitch Day in Hong Kong in May 2014, we saw the strength of the Hong Kong FinTech ecosystem and the high quality of FinTech startups. We are keen to meet FinTech startups and connect them with leading industry experts and mentors. Pitch Days are a great opportunity for startups to receive valuable feedback on the venture and being introduced to the right people in the right positions. We believe that Hong Kong with its strong financial sector and entrepreneurial talent is ideal to nurture the next FinTech players. As a result of that, startups entering the global stage benefit from Startupbootcamp FinTech’s worldwide network of banks and investors.

What can investors expect to get out of this event? What can startups expect?

As an investor you are able to see early stage startups that might not have been on the radar yet and pitch for the first time. A startup can expect great feedback, introductions and sometimes even a starting point of a long relationship. We’ve seen in past Pitch Days that startups met future investors and even customers.

It is also a fun event with a lot of energy to really support early stage startups and bring the community together.

Should banking people attend?

For sure! Banking people are normally experts in their field and can provide a lot of valuable insights into certain aspects of a banking infrastructure. Startups hugely benefit from this experience and appreciate the shared knowledge. On the other side, bankers enjoy getting ‘outside the building’ and being amongst energetic entrepreneurs that are coming up with innovative ideas.

How is HK seen as a startup hub on the world stage?

Hong Kong has developed into a very serious startup ecosystem with huge potential in the next years. These days it is not just anymore about being entrepreneurial, it is about specialising in certain areas of entrepreneurship. Hong Kong shows great quality in FinTech, Internet of Things, Big Data, Property and Hardware. I am looking forward to seeing more startups out of Hong Kong that are entering the global stage. If certain support mechanisms will be developed, it will become even easier to start a venture.

What is some advice you can share with HK startups looking to get into Fintech?

There are two main points that I would give a FinTech startup:

-

Start talking to your potential customers as early as possible. Either if it is banks or the end consumer, it takes longer to validate an idea and establish trust. Financial Services are still a conservative field and by understanding the pain points as soon as possible it is ensured to buil a great product that is really needed.

-

Start talking to investors as early as possible. Even though money is more and more available, it takes longer to build a FinTech startup and sales cycles can be incredibly long. By keeping investors updated from time to time helps to close rounds quicker if needed.

Overall it is a great time to start a FinTech startup and banks are desperate to find innovative solutions. Talk to bankers, get to know their problem and start building a solution!